What are the advantages of having an integrated financial plan?

During these uncertain times, establishing clarity around the topic of money is one of the most important things you can do to enhance the wellbeing of you and your family. To do this, you’ll need an integrated financial plan!

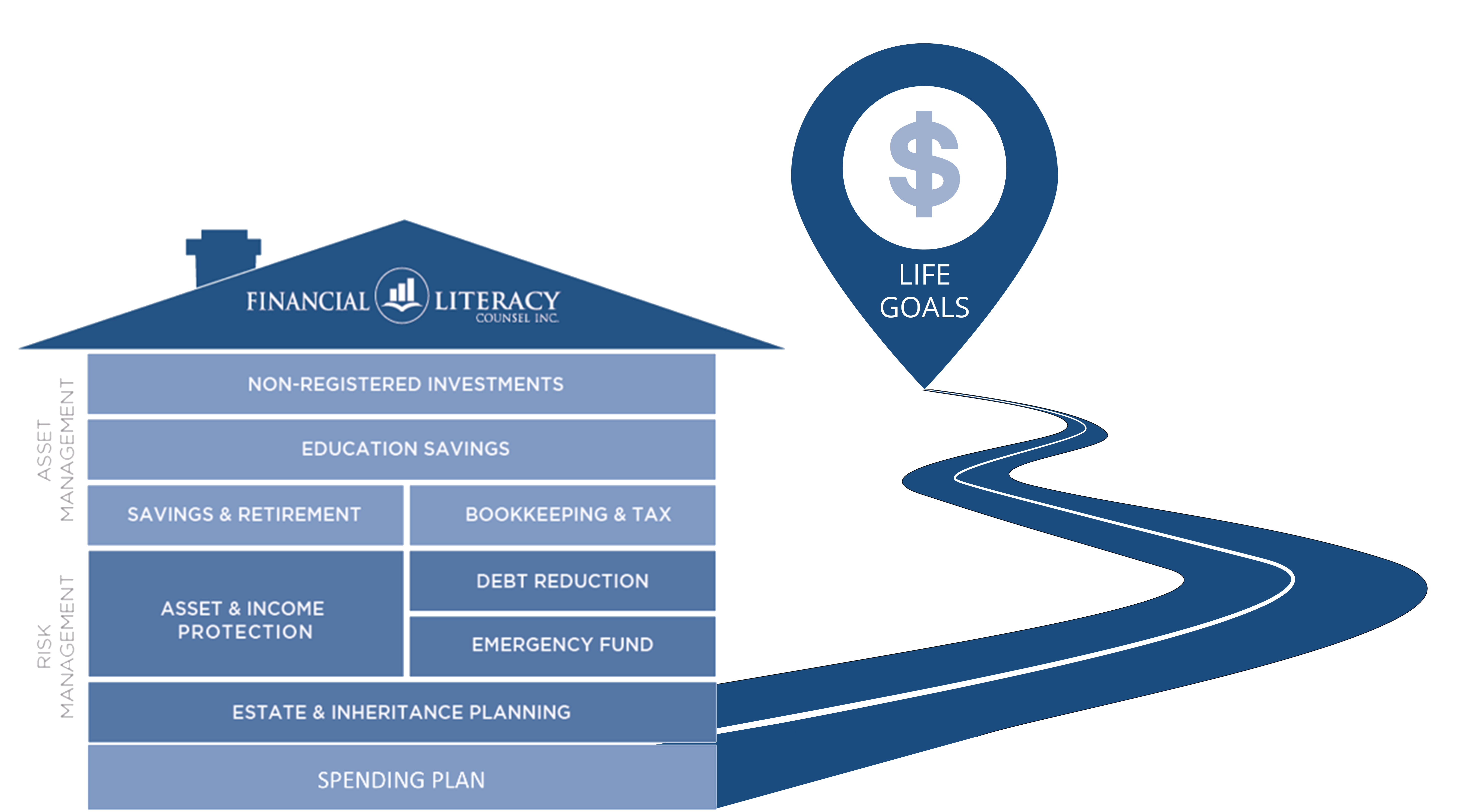

A truly integrated financial plan encompasses cashflow management, insurance, investments, as well as tax, retirement, and estate planning. Not only does this plan act as a roadmap for reaching your goals, it also helps you take control of your finances as your needs change throughout your life.

Over the past 21 years, we have walked this journey together with each of our clients to put their financial house in order. FLC has witnessed, firsthand, the advantages of having a truly integrated financial plan.

While there are many advantages of adopting an integrated financial plan, there are three that cultivate a greater lasting impact: Communication, Collaboration, and Continuity.

1. COMMUNICATION

An integrated financial plan communicates what is most important and meaningful to you. It eliminates the guesswork associated with prioritizing what to do with the money you earn, and you can look to your plan as a reminder of the goals you’ve set for yourself, your loved ones, and/or your business. It also communicates your priorities to others, reflects your values, and outlines the milestones you want to achieve during your lifetime

Here are some tips to ensure your integrated financial plan clearly communicates what is important to you:

- Establish S.M.A.R.T goals: It is important for your goals to be clear so you can communicate what they are and when they are considered accomplished. Set goals that are Specific, Measurable, Achievable, Realistic and Timely.

- Establish value and purpose driven goals: When a goal is aligned with your values and purpose, it becomes personalized. Personalized goals are strong enough to answer the question, “WHY?”, which can increase your commitment to making those goals a reality.

2. COLLABORATION

According to the Book of Proverbs:

“Plans fail for lack of counsel, but with many advisers they succeed”

An integrated financial plan ensures your trusted advisors—financial planner, accountant, lawyer, and banker—are working off the same roadmap to not only save you time and money, but also improve the likelihood of successfully accomplishing your goals.

Here are some tips to ensure that your integrated financial plan facilitates collaboration between your trusted advisors:

- Work with experts who understand your journey: Define your expectations with your financial planner, accountant, lawyer, and banker from the very start. Make sure they are working together to provide you with integrated advice.

- Review your financial plan twice a year: As per the quote by Peter F. Drucker, “What’s measured, improves”. Therefore, it is vital for your financial planner to review your plan at least twice a year to ensure it is adapting with the changing priorities in your life.

3. CONTINUITY

Integrated financial planning preserves your legacy for future generations.

Whether you are a wealth creator or wealth inheritor, an integrated financial plan provides a roadmap for estate planning and increases the financial literacy of your heirs and beneficiaries. This will better prepare them for the challenges and opportunities of managing inherited wealth and protect them from falling prey to the three-generation rule.

The three-generation rule is often described by a quote popularized by Dr. Leon Danco, author of Beyond Survival: “Shirtsleeves to shirtsleeves in three generations”. Danco’s research has shown that the third generation often cannot manage their inheritance, thus the company that created the family wealth fails and all the money it generated evaporates.

Here are some tips to ensure that your integrated financial plan facilitates financial preparedness and a continuity plan for your wealth for future generations:

- Begin with the end in mind: Estate and continuity planning are core components of an integrated financial plan. Raise these discussion topics in your next meeting with your financial planner.

- Maximize the benefits of insurance: Life insurance preserves the value of your estate. Talk to your financial planner about how to effectively utilize insurance solutions for the continuity plan for both your personal and business assets.

Simply put, integrated financial planning provides three important advantages when it comes to improving your financial wellbeing and moving forward towards reaching your life goals.

Since 1999, Financial Literacy Counsel (FLC) has helped thousands of families get their financial houses in order through integrated financial planning. During Financial Literacy Month, we invite you to learn from our experience moving families financially forward. Whether you are already a client or are new to FLC, we look forward to connecting, getting to know your story, and accompanying you on your financial journey.