Break the Bias is the theme for 2022 International Women’s Day on March 8. The focus is on creating a gender-equal world, free of bias, stereotypes, and discrimination.

At Financial Literacy Counsel that means continually removing the barriers that make it difficult for women to move financially forward. For over 20 years we have remained committed to closing financial gender gaps and levelling the playing field through financial education and unbiased financial planning. One of our goals is to bring awareness to the deliberate and unconscious biases that impact women’s experience and their ability to control their finances and build wealth.

Over the years, there are three common biases we continually witness when speaking to women who participate in our workshops and programs. The key is to be aware of them and take action to #BreakTheBias.

Bias #1: Women are not primary financial decision-makers

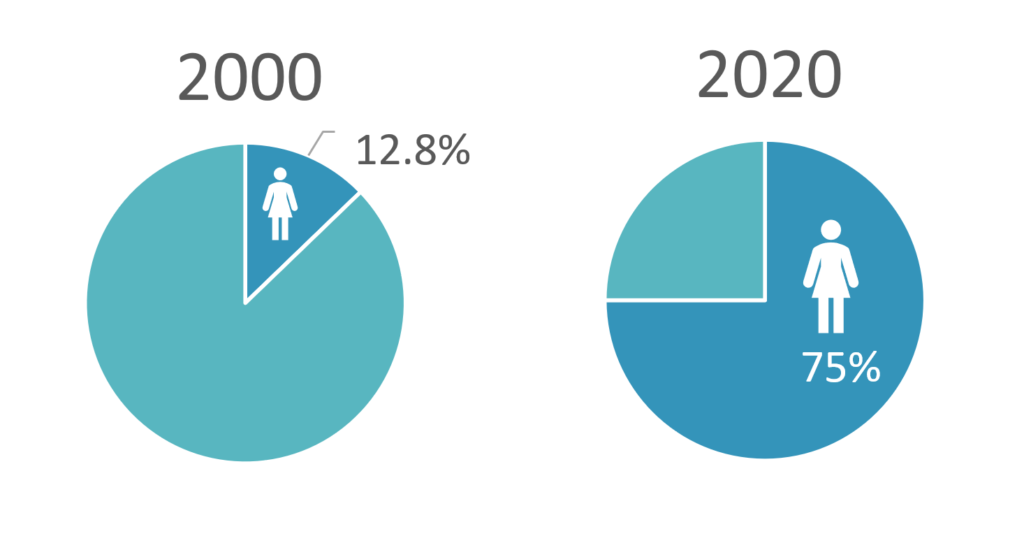

Times have changed. A study by Merrill Lynch[1] focused on the role of gender in wealth management, found that, in 2020, 75% of married women under age 45 are the primary financial decision-makers, compared to only 12.8% in 2000. Moreover, a study by the Government of Canada[2] proposes that by 2026, women will control close to 50% of all accumulated wealth, a significant increase compared to 2007 when it was closer to 33%.

Attitudes towards women within financial, legal, and accounting services need to change. Our team has heard countless stories from women who have felt talked down to by these professionals. Women are also being recommended more conservative investments and missing out on potential growth opportunities because it is assumed that most women are risk-averse.

According to Morningstar Canada[3], the first step to minimize gender bias is for advisors to employ a common job interview technique called the structured interview, which uses a standard set of questions. By consistently using the same questions for all clients, they will be able to collect pertinent data related to a woman’s financial life, priorities, and life goals.

Bias #2: Women ask too many questions

Unfortunately, this is a negative cultural bias that is not exclusive to financial planning. Asking questions can often be incorrectly interpreted as a lack of confidence or feeling unsure. However, we would argue that:

Not asking questions is one of the key areas people go wrong when it comes to their finances!

If you have a question, you should feel confident and safe enough to ask your financial advisor. If your advisor is unwilling to answer all of your questions, find one that will.

Bias #3: One size fits all when it comes to financial advice for women

Over the last 20 years, we have found that women are becoming the new face of wealth in Canada as they earn more, create wealth by owning profitable businesses, and inherit wealth from baby boomer parents. Cookie-cutter advice based on old assumptions and stereotypes needs to change.

Unfortunately, the majority of financial, tax and estate planning advice women have been receiving is not meeting the changing realities and the needs of women today.

Financial advice by its very nature must be individualized and focused on women’s specific values, goals and needs—there is no one size fits all solution. Several factors need to be considered when creating a financial plan such as longer life expectancy and a woman’s definition of wealth.

We encourage all women to create a holistic financial plan that goes beyond investing. Your financial plan should consider your present and future needs and goals by integrating financial, tax, retirement, and estate planning. Work with someone who understands your journey and will act as the Team Captain to your accountant and lawyer in order to optimize your tax and estate planning opportunities.

At FLC Inc., we are grateful to all the women who have championed our work over the years but there is still a lot more to do to break barriers and level the playing field to help women understand the language of money, build wealth, and make confident informed financial decisions to reach their life goals.

International Women’s Day is a chance for all of us to pause and reflect on our own attitudes, actions and biases that impact the people around us. We believe we all have a part to play in facing our own bias and committing to changes that will leave people better off.

[1] Merrill Lynch. Seeing the Unseen: The Role Gender Plays in Wealth Management.

[2] Strategic Insight. (2017). Investor Economics Household Balance Sheet Report – Canada 2017.

[3] Morningstar Investment Management. (February 13, 2020). Eliminating Gender Bias in the Advice Relationship.