Teaching your children the basics of spending & saving will provide them with a solid foundation to build healthy money habits throughout their lives.

Many of the cognitive functions related to understanding basic financial concepts are developed by the age of seven. At this point, parents can use modelling and experiential approaches that incorporate discussion and demonstration to have an impact on your child’s money habits.[1]

Since financial literacy begins at home, we coach parents using a 3-step approach allowing their children to gain hands-on experience with money. The following exercise is geared towards children ages 8 to 13.

The goal is to foster self-control and patience, which are not only the building blocks of success in finance, but success in life!

The 3-Step Approach

Step 1: Establish a Weekly Allowance

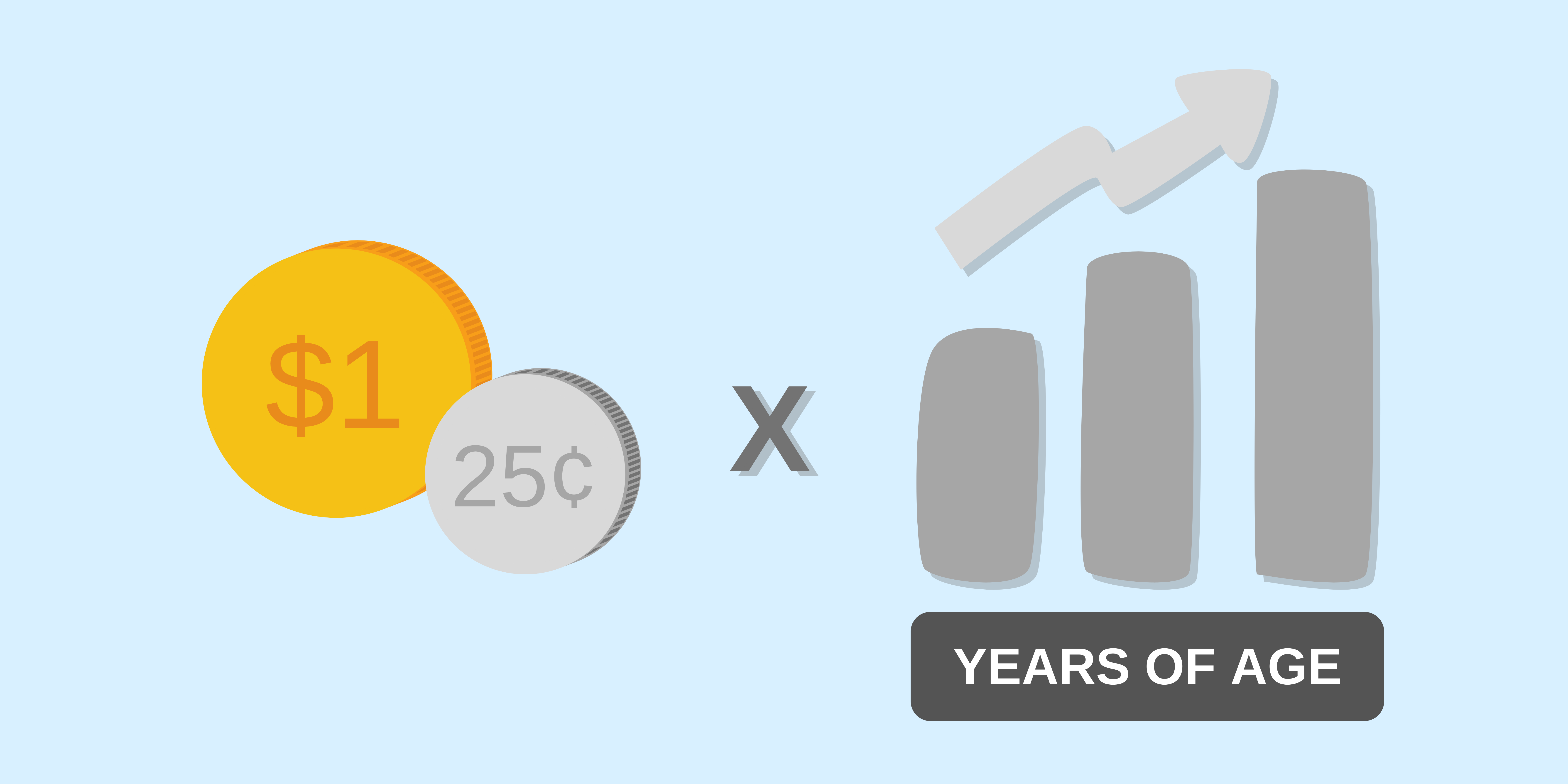

An appropriate amount of weekly allowance is $1.25 per year of age; e.g., an 8-year-old child would receive $10 per week.

It’s never too early! You can begin giving an allowance to a child as young as 4 years old. This is when children form a foundational understanding of certain financial concepts like paying for merchandise[1].

Try not to tie allowance in with doing chores; rather, it should be a benefit of being part of the family. Although this may seem counterintuitive, you want to avoid your children habitually probing, “How much are you going to pay me?”, every time you ask them to help out around the house.

Step 2: Label 3 Jars—Share, Save & Spend

Make this next step into a fun arts & crafts project with your child. Create 3 jars with the following labels: Share, Save and Spend.

Each week, divide the allowance up into 20% share, 20% save and 60% spend. For example, an 8-year-old child receiving $10 per week will put $2 in the sharing jar, $2 in the savings jar, and $6 in the spending jar.

Have the child choose a “big-ticket” item they want to save towards. You can even print out a photo and add it to their savings jar for motivation.

As for the spending jar, they can spend this money on whatever they like each week or choose to save some of it as well.

In today’s world of tap & go credit cards, payment apps, and eTransfers, it’s easy to overlook the value of money. Therefore, it is essential to use cash in this exercise. This will encourage the child to visualize reaching their savings and sharing goals.

If they can see it, they will value it more!

Step 3: Give to a Good Cause

Give to a good cause when their sharing jar hits $100. Take the time to teach your children that,

“with great power comes great responsibility”.

Children need to see how money can positively impact the world around them. This will help them understand how giving helps both the giver and the receiver.

Have your child research a social issue or charity in your community and tell you why they want their sharing jar to go towards this cause.

Don’t underestimate your child’s drive to do good! A small step can make a big difference; just take some inspiration from Cassandra Lin, Yash Gupta, or Mary Grace Henry.

Here’s a BONUS tip:

Create a teachable moment by inviting your children into the conversation about their RESP. Introduce them to a few of the companies you’re invested in, explain the power of compound interest, and increase their awareness of passive income. They will be amazed that they are making money while they sleep!

Families are the basic building blocks of society. At Financial Literacy Counsel, our vision is to create a financially literate world of stronger families and communities for generations to come.