Welcome! November is financial literacy month! With all of the economic uncertainty in the news, Financial Literacy Counsel (FLC) has decided to kick off financial literacy month with a market update. We would like to take this opportunity to address some questions you may have around the possibility of a recession, high inflation, and your investment portfolio.

Are we going into a recession?

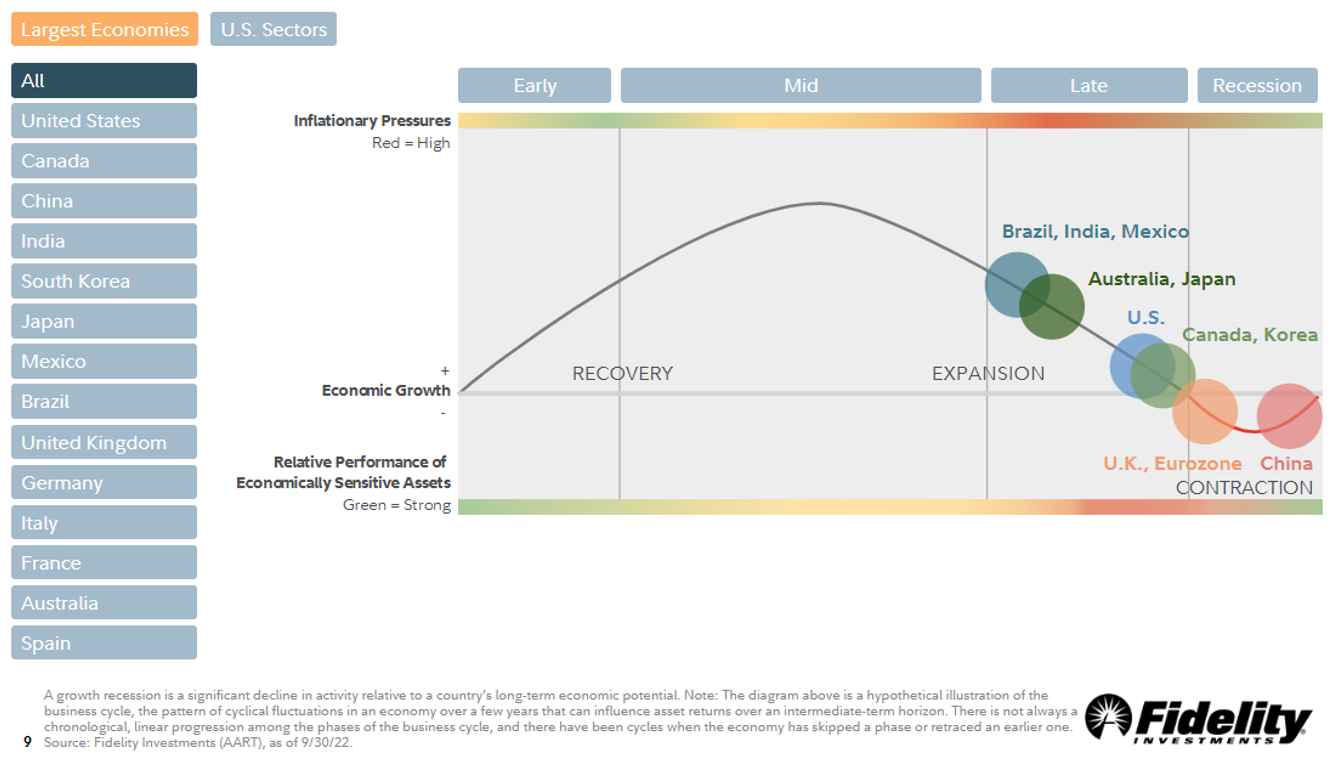

In short, we believe that a recession is likely. Illustrated in the graph below, Fidelity has positioned Canada to be quite late in the business cycle and nearing negative economic growth. However, there are a couple of silver linings to point out here. The first is that we predict inflationary pressure to reduce from its highs. The second is that markets tend to be forward looking so we can expect to start seeing a market recovery before the economy bottoms out. This is because investors factor in a number of variables, including the current economic outlook, when they consider what an investment is worth. If investors all have access to the same information, then it will be reflected in the investment’s current price.

What changes should I make to my portfolio?

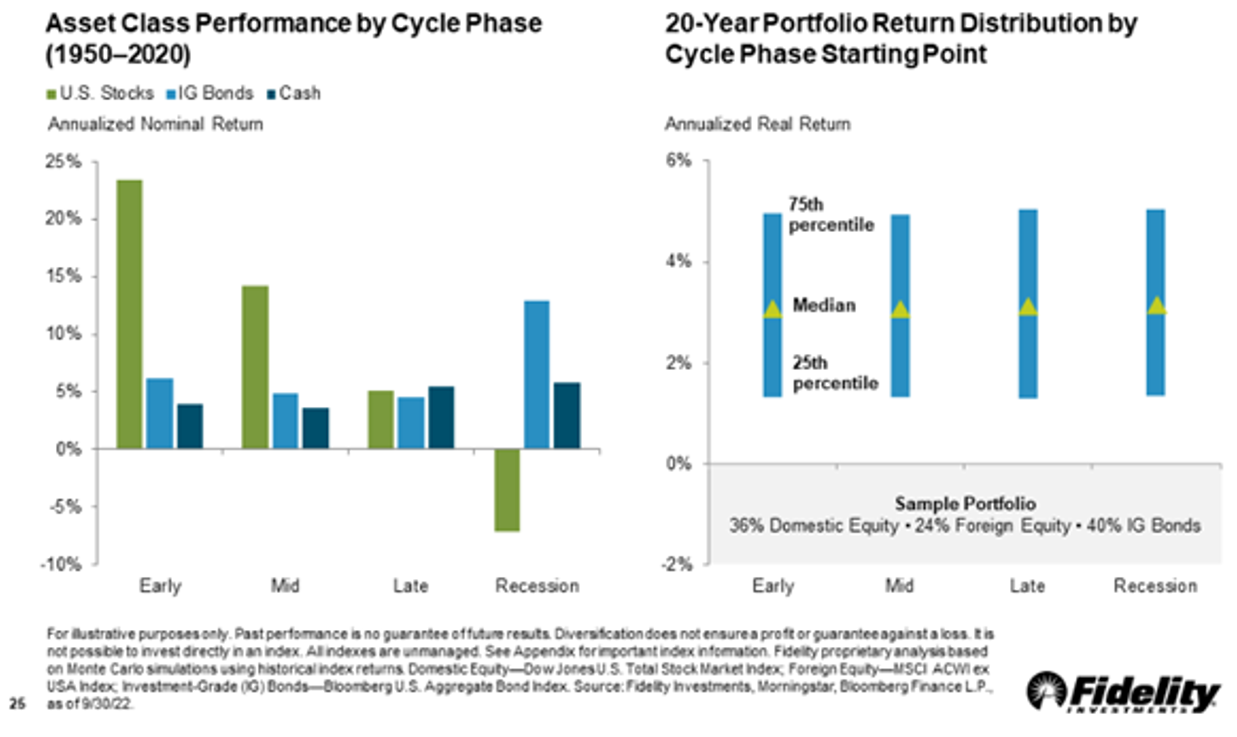

While the business cycle is important and may affect an investment’s performance and “ideal” asset allocations, this effect is reduced over longer periods of time. The chart on the left illustrates how stocks, bonds, and cash have fallen in and out of favour in different phases of the business cycle. The chart on the right shows how a portfolio’s median performance in each phase evens out over 20 years. This suggests that if you have a solid plan and a longer time horizon for your investments, you will end up in the same place that you are supposed to be. That said, there can still be value to taking a more active approach, as the switches between different asset classes can help boost returns and reduce volatility.

What about high inflation?

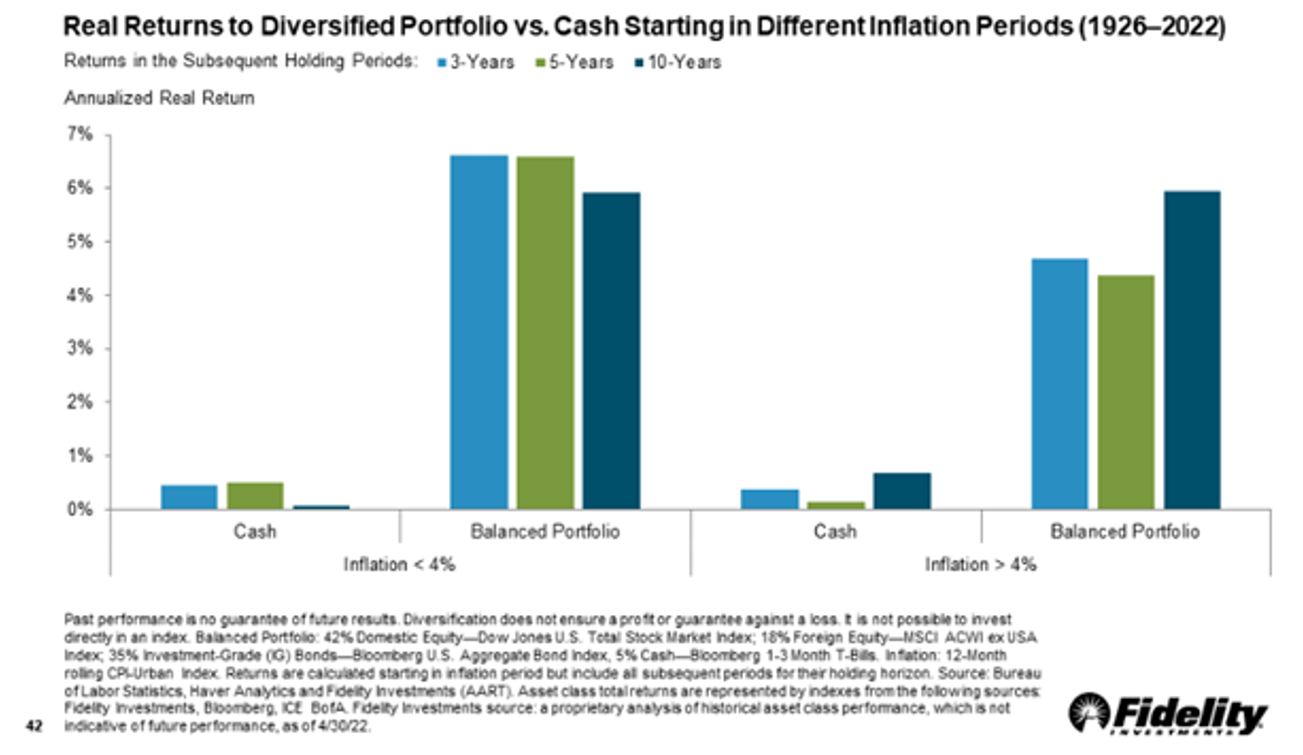

With a looming recession, investor sentiment is understandably low. Moving to cash may seem attractive for some who have been burned, but Canada’s September inflation figure of 6.9% means that your dollar will not carry the same value that it used to. By staying invested, even in lower risk options like fixed income, you are acting to help offset the loss of purchasing power. Further to this, the chart below shows that historically, a balanced portfolio has performed better than cash when started in both periods of low and high inflation.

What does this all mean?

The oncoming forecast of a recession has caused many of us to be alarmed. When panic sets in, it is human nature to forget about the long-term path that we are on, and we tend to only focus on what is directly ahead of us. It is essential to note that what we are experiencing is part of a cycle. Though it may be unnerving now, history shows that markets eventually recover and enter periods of growth.

At FLC, our advisors can give you a better understanding of the markets and how they affect your portfolio. Since every person’s situation is unique, clear up any concerns you may have by contacting your financial advisor.

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This article was written, designed and produced by Financial Literacy Counsel, a registered trade name with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this article comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Source: https://institutional.fidelity.com/app/popup/item/RD_13569_30073.html#slide8

Source: https://institutional.fidelity.com/app/popup/item/RD_13569_30073.html#slide25

Source: https://institutional.fidelity.com/app/popup/item/RD_13569_30073.html#slide41

Source: https://www150.statcan.gc.ca/n1/daily-quotidien/221019/dq221019a-eng.htm