Canadian employees are financially stressed, and employers are starting to listen.

According to BDO Canada’s Affordability Index 2022[1], 54% of Canadians are living pay cheque to pay cheque as the cost of living continues to rise. With ongoing inflation and a looming recession, this further stresses households and affects workplace productivity [13] [14].

What is the impact of money stress on employees?

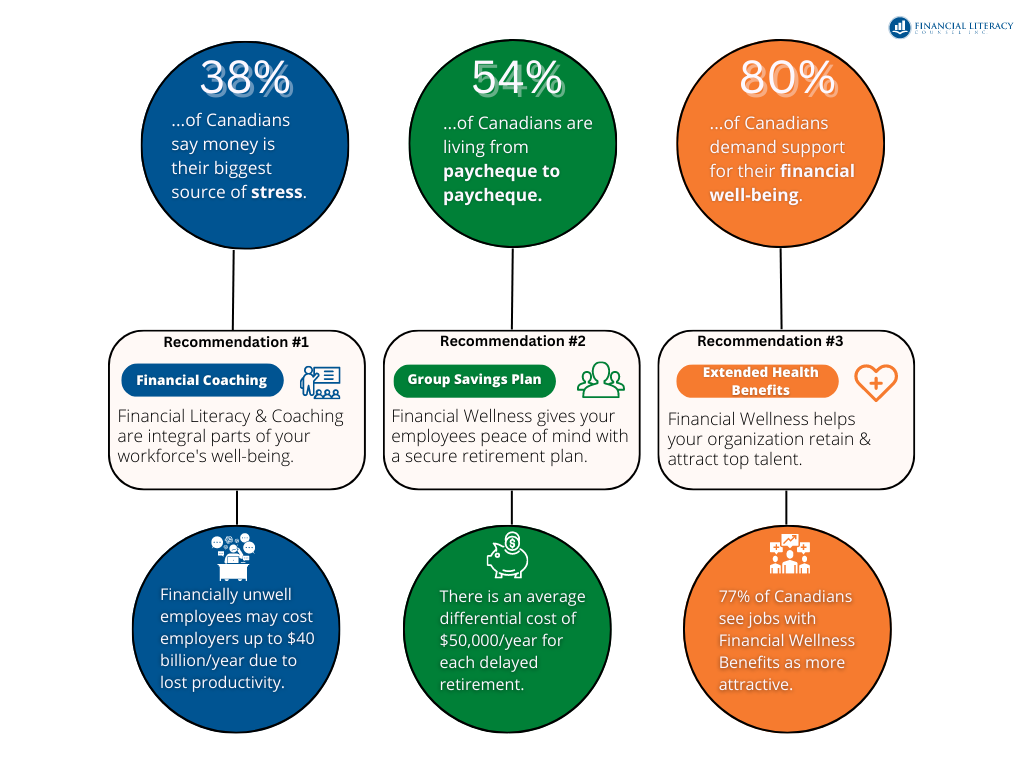

Employees throughout Canada cite money as one of their biggest stressors. FP Canada’s (2022) survey [5] found that 38% of working Canadians have ranked money as their biggest source of stress. For business owners and executives, this has a spillover effect, as a financially distracted workforce costs Canadian employers up to $40 billion/year in lost productivity [9] [3].

Employers are asking: How can we improve the financial well-being of our employees?

By putting the financial well-being of your workforce first, employers help their organization increase employee engagement and resilience. For organizations that have established Diversity, Equity, and Inclusion (DEI) programs, adding financial wellness will strengthen outcomes by providing employee access to resources to improve their financial health [13] [14].

Here are 3 recommendations that employers can implement to reduce employee money stress:

1. Provide a comprehensive financial literacy and coaching program

Financial literacy and coaching are an integral part of your employees’ well-being.

It has been a growing trend for organizations to include financial literacy workshops to improve the overall financial health of employees [12]. However, it needs to go beyond simply providing a workshop. It also needs to give employees the opportunity to access personal financial coaching to develop the right habits and accountability. Organizations with comprehensive employee financial literacy programs help their workforce manage their financial worries and show them the importance of saving for retirement [6] [16].

Research has also shown that professionals who are financially well and adjusted are 200% more productive than professionals who have financial worries [4]. A prominent by-product of money stress is presenteeism, which is described as a state of chaotic distraction during work [15]. A financially unwell employee can spend as much as six hours a day worrying about their personal financial problems [16].

2. Offer a retirement savings program

Financial wellness gives your workforce peace of mind with a secure retirement savings plan.

Another financial resource employers can provide their workforce is a group savings plan. This builds on the premise built by a good financial literacy program – the importance of saving and investing for retirement. Organization members who have high financial literacy tend to develop more positive feelings regarding their work and employers; this translates into a 15% growth in the usage of employer-sponsored retirement plans and a 10% increase in maximum contributions [4].

By proactively helping the workforce with their retirement plans, employers also prevent another by-product of money stress: delayed retirement. There is an average differential cost of $50,000/year for keeping an employee who has chosen to delay their retirement as compared to hiring a new one [4] [10]. For an organization with 200 staff members, that amounts to an incremental cost of $1,000,000/year.

3. Reimagine your extended health benefits

Financial wellness helps your organization attract and retain top talent.

Statistics Canada (2022) [17] reveals that Canada’s unemployment rate hit a record-low of 5.1% as of last March, but still a significant portion of the workforce is jobless. Even with a large pool of applicants to choose from, recruiters are still frantically trying to fill over a million job vacancies across the country. It is evident that there is a large mismatch between skilled labour and the job vacancies in Canada.

What can recruiters and HR practitioners do to attract and retain a skilled workforce?

Around 77% of Canadians say that they would leave their current organization for another that would be able to provide them better support for their well-being – even if that means that they’ll receive a lower salary [8]. Also 80% of Canadians want their employers to provide a financial literacy program [3], since they consider financial health as a critical component of their overall health and well-being. By offering a comprehensive financial wellness program, your organization helps your recruiters and HR practitioners bring in and retain a skilled workforce.

It is human to worry. Ongoing inflation and a looming recession continue to keep us all in a state of uncertainty. The best gift we can offer ourselves and those who depend on us is the gift of financial literacy, which can act as a guiding light through of all this uncertainty. Learn how FLC’s over 20 years of expertise have helped organizations, just like yours, improve the well-being of their employees and the communities they serve.

Learn more about our financial education services: https://financialliteracy.ca/our-services/financial-education/

Financial Literacy Counsel (FLC) is a boutique financial education and financial planning company committed to “building financially literate communities and moving Canadians financially forward.”

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This article was written, designed and produced by Financial Literacy Counsel, a registered trade name with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this article comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Sources:

- (2022, September). Retrieved from https://debtsolutions.bdo.ca/press-and-media/bdo-affordability-index-2022/

- (2017). Retrieved from https://www.benefitscanada.com/news/bencan/80-of-canadian-employees-want-employer-provided-financial-education-survey/

- (2022). Retrieved from https://www.benefitscanada.com/news/bencan/employees-financial-stress-costing-employers-40bn-in-2022-survey/#:~:text=Survey%20finds%20employees’%20financial%20stress%20costing%20employers%20%2440BN%20in%202022,-By%3A%20Staff&text=Employees%20worrying%20ab

- (2019). Retrieved from https://media-cdn.igrad.com/DOCS/PDF/Marketing/Calculate-ROI-for-employee-financial-wellness-program.pdf

- (2022). FP Cananda. Retrieved from https://fpcanada.ca/docs/default-source/financial-stress-index/2022-financial-stress-index-survey-results.pdf?sfvrsn=6595e8a_9

- Frazier, L. (2022, January). Forbes. Retrieved from https://www.forbes.com/sites/lizfrazierpeck/2022/01/19/financial-wellness-is-critical-to-your-overall-healthand-financial-literacy-is-the-key/?sh=5ceed54b2cdc

- (2022, June 16). GlobeNewsWire. Retrieved from GlobeNewsWire: https://www.globenewswire.com/news-release/2022/06/16/2464050/0/en/Half-of-older-Canadians-have-delayed-retirement-because-of-mounting-inflation.html

- Lifeworks. (2020). Retrieved from https://media.lifeworks.com/English/news/news-details/2020/Morneau-Shepell-finds-employees-would-accept-lower-pay-for-enhanced-well-being-support/default.aspx

- (2022). Retrieved from https://www.newswire.ca/news-releases/financial-stress-related-distraction-subtraction-costing-businesses-billions-875017579.html

- (2019). Retrieved from https://www.prudential.com/corporate-insights/employers-should-care-cost-delayed-retirements

- Randall, S. (2022, September 30). Wealth Professionals Canada. Retrieved from https://www.wealthprofessional.ca/news/industry-news/more-canadians-living-paycheque-to-paycheque-with-growing-debt/370284#:~:text=More%20than%20half%20of%20Canadians,crisis%20continues%20to%20squeeze%20budgets

- (2017). Retrieved from https://www.sunlife.ca/content/dam/sunlife/regional/canada/documents/grs/Bright_Paper_Empowering_Employees_to_Improve_their_financial_wellness.pdf

- (2022). Retrieved from https://www.benefitscanada.com/news/bencan/employees-financial-stress-costing-employers-40bn-in-2022-survey/

- (2022). UseOrigin. Retrieved from https://www.benefitscanada.com/news/bencan/employees-financial-stress-costing-employers-40bn-in-2022-survey/

- (2017). Retrieved from https://www.wellright.com/blog/benefits-financial-literacy-education-work

- Yakoboski, P. J., Lusardi, A., & Hasler, A. (2020). Global Financial Literacy Excellence Center. Retrieved from https://gflec.org/wp-content/uploads/2020/04/TIAA-Institute-GFLEC_2020-P-Fin-Index_April-2020.pdf?x38887

- (2022). Retrieved from https://www150.statcan.gc.ca/n1/pub/11-621-m/11-621-m2022011-eng.htm